Many of us have used an overdraft at some point, whether we’ve just needed a little helping hand at the end of the month or an emergency expense has come up. They can be an extremely useful thing to have available. However, if we dip into an unauthorised one, that convenience can become rather expensive rather quickly.

How you manage your money is important when it comes to avoiding unauthorised overdrafts – take a look at our tips and tricks to help you be more money savvy here on Good Vibes page.

For now, let’s take a closer look at unauthorised overdrafts.

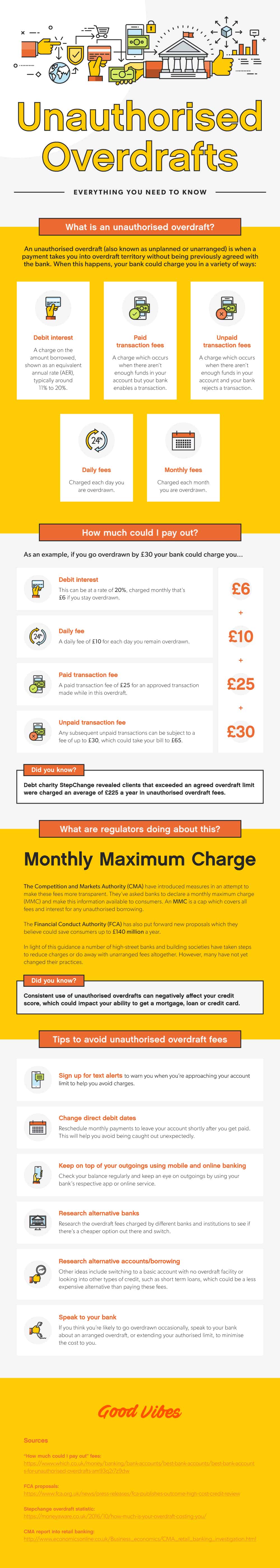

The fees and charges associated with these types of accounts are very high – something many people aren’t aware of. Many unauthorised overdrafts charge interest, transaction fees and daily and monthly fees. For some people, with these charges added on top, it can be very difficult to get out of debt later and they could end up owing a lot more than they initially ‘borrowed’.

Take a look at our guide to unauthorised overdrafts below. We’ve broken down what you need to know, plus the common charges that come with using one. This kind of borrowing may well be the best choice for you at some stage, but as with many things it’s important to be prepared and in the know before you make any decisions.