We’ve all been there. A new product release. A new brand collection drop. Social Media has a huge impact and influence on customers to make them spend their money. Especially with the launch of Tik Tok Shop in 2021, users on the app are more inclined to quickly add an item to the basket and press purchase. It’s just as simple as that. However, managing these habits and finding ways to reduce the temptation can make all the difference to your finances.

1. FOMO (Fear Of Missing Out)

Like most people, we don’t want to miss out on the latest products, from beauty to clothing, indulging in new purchases can be so tempting. When viewing someone’s life through the social media lens, people are seen to have the flashiest cars and the most expensive designer items. Not all things on social media are the reality.

2. The Power of Influencers

Influencers are people who have a large social media following, and their main income comes from being an influencer. Many users are easily influenced by popular influencers on Tik Tok and Instagram when buying certain products. Instagram, Pinterest and Tik Tok are the main social media platforms which supply visual content, including videos, photos and reels, and encourage people to buy what influencers have.

3. Targeted Ads

Have you ever noticed that after searching for a certain item on one device, you start seeing ads for that brand on Facebook every time you open the app? This is because brands invest in targeted marketing to earn a return on their investment. It is crucial to keep in mind that this approach could impact your expenses. However, it is vital to remain mindful of your financial plan and not deviate from it.

The Pressure of Social Media

As more and more people are pressured into buying the latest items, social media influencers advertise schemes, including buy now pay later services (BNPL), like Klarna or PayPal. One important aspect not often discussed by BNPL schemes is that it essentially converts your purchases into loans that come with interest rates that can be as high as 30%. Interestingly, more than 25% of these individuals learned about BNPL services through social media, as found in The Ascent’s survey.

Here’s what people reported about their experiences with BNPL:

- 67% of BNPL users think the scheme could replace their credit cards.

- 47% of users say they’ve used BNPL to buy electronics, found to be the most common use of the BNPL scheme.

- 38% of BNPL users say they use it once a month or more.

- 33% of BNPL users have made a late payment or have been issued a late fee.

How To Enjoy Social Media Platforms Without Spending Money

From keeping your apps out of sight to silencing your notifications on your phone, limiting the time spent on your phone can help reduce the temptation that social media causes.

Limit Your Social Media Usage

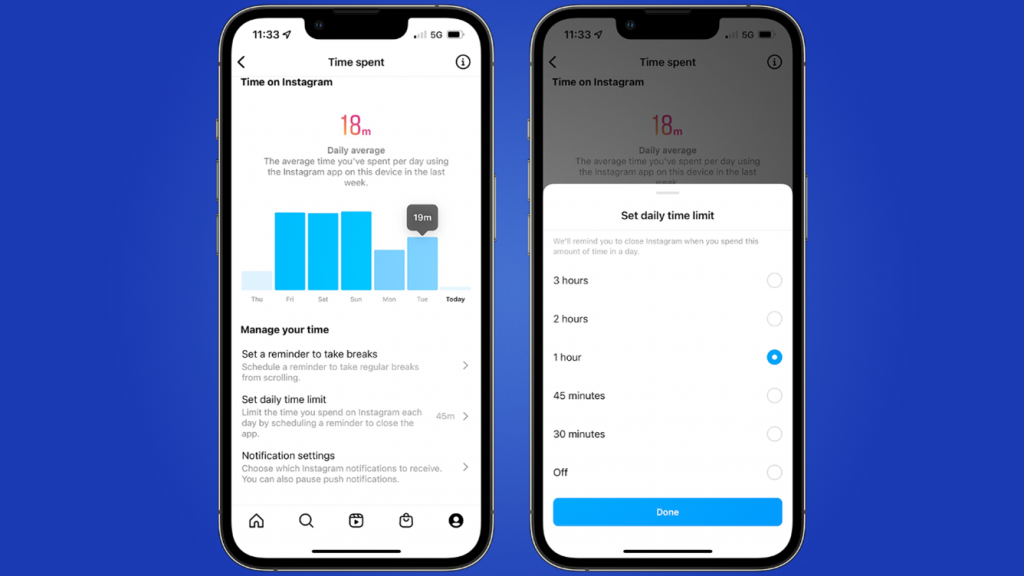

To ensure that you limit your social media use, there are some simple methods to help reduce your time spent on the apps. On your iPhone and social media apps, you can set yourself a time limit, as this will help with reducing your time spent on social media apps which in turn will reduce your spending habits. To do this, you will need to click on the 3 lines in the top right corner of your profile > your activity > time spent > set a reminder to take breaks or set a daily time limit.

Remove Any Payment Options On Your Phone

Like most people nowadays, Apple Pay or Samsung Pay is an easy way for people to purchase things on their phones, whether this be online or in-store. By removing these payment methods, your spending habits may be reduced and help you to save for more important and urgent emergencies.

Put Notifications on Silent Mode

Keeping your phone at bay and silencing your notifications on your shopping apps and social media platforms can help reduce your spending habits. You can even completely turn your notifications off, so you won’t be tempted to look to see what notifications you have.

Have Tunnel Vision With Your Budgeting

It’s important to try not to let your friends spending influence your own too heavily. Taking ideas from the experiences of others can be a great way to broaden your horizons and explore the world. But, it is almost impossible to tell how your old schoolmates, distant cousins, or even some of your nearest and dearest are affording what they post about online. It might not even be quite as it seems.

How to Improve Your Social Spending Habits

The best thing to do would be to delete all your social media accounts, as this would begin to break the habit of spending money. Removing any sort of banking details or information from your online wallet on your phone will reduce your clicking on Apple Pay or Samsung Pay. However, here are some ways to keep those accounts, enjoy regular content but limit your spending habits.

- Remember, social posts are not always what they seem. We all present our best selves online, so no one has the full story behind each picture or post, and therefore how much money has gone into this lifestyle.

- Take a break. Try not to spend too much time going on social media. This will help reduce the overall temptation of buying on Tik Tok, Twitter, Instagram, Pinterest & Facebook.

.It may be difficult, but finding chances to relax, disconnect for a bit, and focus on what really matters to you can give you a lot more enjoyment and incredible memories.

- Put your own personal finances first. Work out what you can actually afford before going all out to match your friends. You can always book a shorter break or search online for sales deals to make a savvy purchase.

At the end of the day, everyone has their own spending rituals of what they want to spend their money on and where on a weekly or monthly basis. However, making sure that you aren’t making comparisons with influencers or friends online can make all the difference.

For more money-saving advice, see our budget living blogs to discover many more ways you can save.